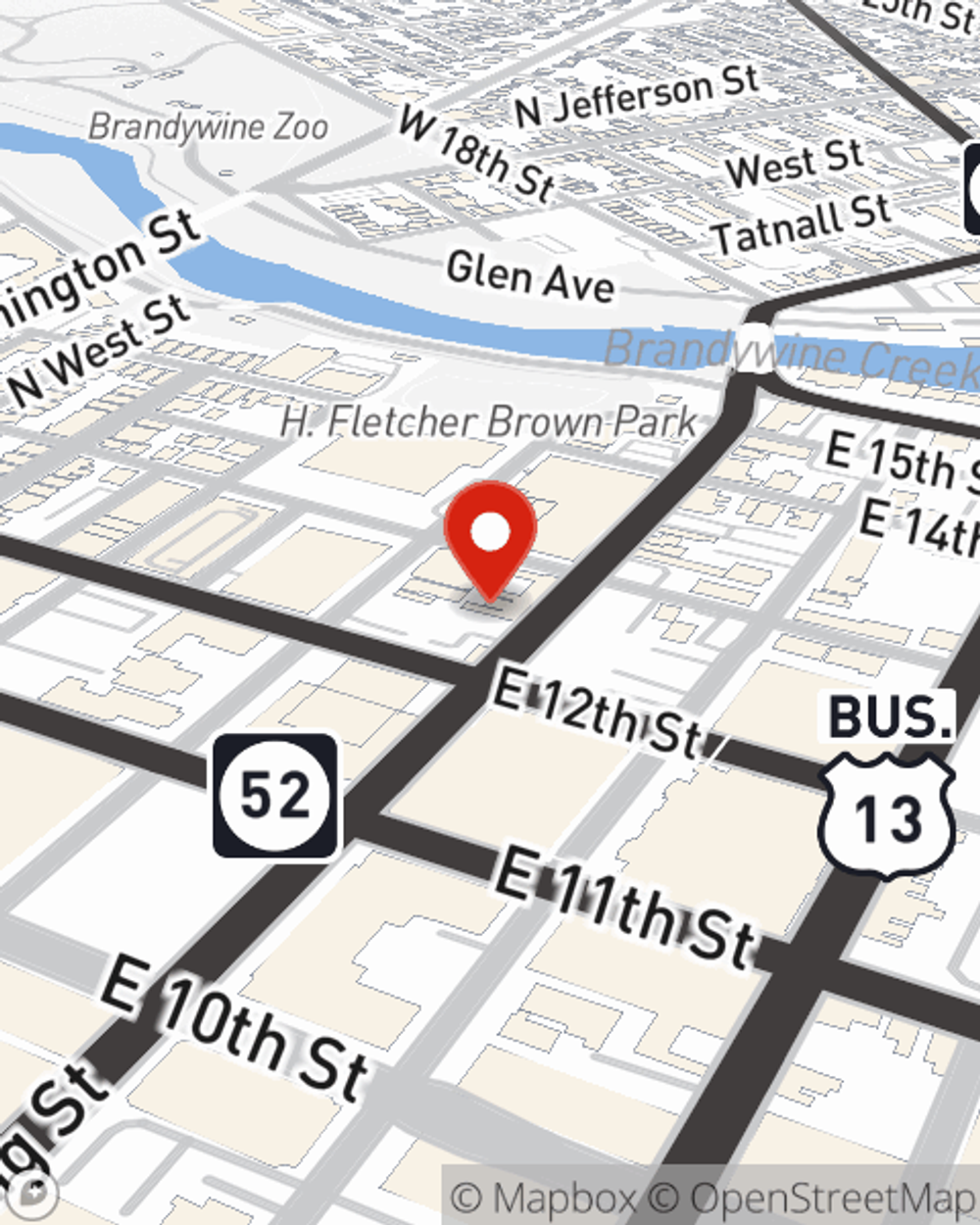

Life Insurance in and around Wilmington

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

No one likes to think about death. But taking the time now to arrange a life insurance policy with State Farm is a way to express love to the people you're closest to if you're gone.

Protection for those you care about

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

Having the right life insurance coverage can help loss be a bit less overwhelming for the people you're closest to and give time to recover. It can also help cover bills and other expenses like medical expenses, home repair costs and phone bills.

If you're looking for dependable protection and responsible service, you're in the right place. Talk to State Farm agent Garland Thompson now to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Garland at (302) 407-6262 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Garland Thompson

State Farm® Insurance AgentSimple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.